The world of e-commerce is rapidly expanding beyond local markets, presenting unprecedented opportunities for businesses looking to grow. Global cross-border e-commerce is a rapidly growing market, projected to reach a staggering $1.47 trillion in 2025. This growth is fueled by strong Compound Annual Growth Rates (CAGRs), with Coherent Market Insights forecasting an 18.4% CAGR for the period between 2025 and 2032. The Asia-Pacific (APAC) and Southeast Asia (SEA) regions are particularly ripe with potential, with APAC’s e-commerce market anticipated to hit $4.62 trillion in 2025, and SEA forecasted to surpass $230 billion by the same year.

What’s fueling this immense growth?

Several key factors are at play: high mobile penetration rates, a youthful and digitally-native consumer base, escalating disposable incomes, and supportive government policies. Consumers in these regions are transitioning from traditional retail to mobile-first and social commerce experiences. This rapid digital adoption means consumer preferences evolve swiftly, demanding high adaptability from brands.

Mobile and social commerce, particularly live selling (Live Commerce), are significant components of this growth, with China leading the growth in the space. Popular product categories driving this trend include electronics, fashion, and beauty products. Vietnam, Thailand, and Indonesia are recognized as the three most promising markets within SEA for this expansion.

If your business is keen on expanding to Asia or Southeast Asia, consider the key factors below to ensure success.

Key Factors for Cross-Border Expansion

1. Product-market fit

Before expanding across borders, it’s critical to assess whether your product truly aligns with the needs and conditions of the target market. A strong product-market fit is the foundation for long-term success and sustainable growth.

Market Size and Growth Potential: Target markets that are sufficiently large and demonstrate adequate growth to justify your investment.

Consumer Needs, Preferences, and Behaviors: A deep understanding of unique local demands, cultural values, and shopping habits is essential, especially for catering to needs and preferences. IKEA’s success in India involved adapting its product range to include smaller furniture suitable for Indian homes.

Know your competition: Understanding local players and their strategies is vital. Amazon’s exit from China shows that even global giants can lose without understanding local players. It couldn’t match the speed, pricing, and seamless experience offered by Tmall and JD.com, proving that local insight beats global scale when competition is this fierce.

2. Platform strategies that fit your needs

Choosing where to sell is just as important as what to sell. The right platform strategy depends on your brand goals, operational readiness, and the level of control you want over the customer experience.

Direct-to-Consumer (D2C): Platforms like Shopify empower brands with complete control over branding, messaging, and the customer journey. This allows for direct customer relationships, first-party data collection for personalized marketing and product development, and generally higher profit margins due to the absence of marketplace commission fees.

Marketplaces: Platforms like Shopee and Lazada are popular options. They offer immediate access to a large, established customer base and benefit from existing consumer trust. They often simplify operational complexities by handling aspects of payment processing and sometimes logistics. The initial setup cost to gain visibility can also be lower compared to building a D2C presence from scratch.

Social and Live Commerce: The rise of platforms like TikTok Shop, Instagram, and Facebook Shops has created new, dynamic sales channels where consumers shop directly through engaging content and livestreams. Live commerce, in particular, blends entertainment and conversion, offering an opportunity to boost engagement and drive impulse purchases in real time.

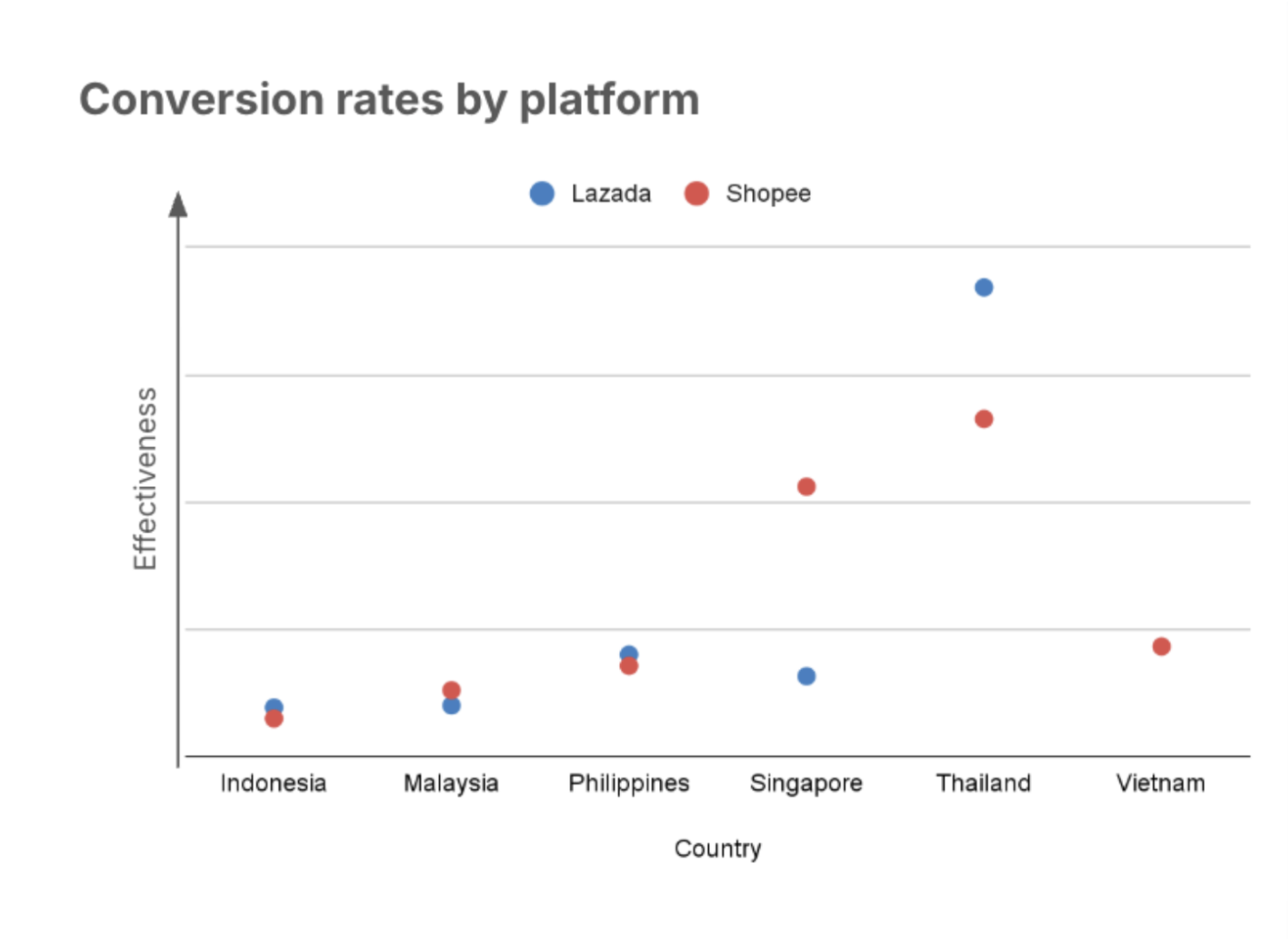

Tip: According to our SEA Digital Landscape 2025 report, Shopee and Lazada are popular options for commerce in Southeast Asia. See our full report for more information on the platforms’ ad click-through rates (CTR), return on ad spend (ROAS), conversion rates, and more!

Image 1: Conversion rates by platform.

(Source: SEA Digital Landscape 2025 Report)

To help businesses stay on top of this multi-channel environment, AnyX serves as a unified platform that consolidates and streamlines operations across D2C websites, e-commerce marketplaces, and social/live commerce channels. With AnyX, brands can manage inventory, orders, customer service, and performance insights through a single dashboard, enabling smarter decisions, better coordination, and faster growth at scale.

3. Localization

Localization goes far beyond simple translation. It involves a holistic adaptation of all business aspects to deeply resonate with local audiences, from marketing and customer support interactions to accepted payment methods and currency display. The goal is to make international customers feel understood and valued as if the brand is native to their market. Studies show that 76% of online shoppers prefer to purchase products with information available in their native language, and 40% would never buy from websites in other languages. Effective localization builds crucial trust and familiarity, directly influencing conversion rates.

Deep cultural localization, which involves understanding underlying cultural values and subtle local nuances, can even uncover new market segments. The classic study of Nestlé in Japan illustrates this point:

When Nestlé first entered the Japanese market, their instant coffee sales fell flat due to the prevailing tea-drinking culture. To overcome this, Nestlé implemented a long-term strategy by introducing coffee-flavored candies to children, gradually accustoming them to the taste. A decade later, they successfully re-entered the market with coffee offerings, targeting these now-adult consumers who had developed a palate for coffee, leading to significant success and market leadership.

4. Logistics and fulfillment

In regions like Southeast Asia, expanding across borders presents logistical challenges that can directly impact customer satisfaction. Less developed transportation infrastructure, complex customs procedures, and fragmented shipping networks often result in longer delivery times, higher shipping costs, and an increased risk of damaged or delayed items.

To overcome these challenges, choose a fulfillment model that fits your operations and customer needs. Here are the most common options:

Direct Cross-Border Shipping:

- Orders are shipped individually from the seller’s country of origin.

- This model has a lower initial investment and is suitable for testing new markets, but comes with longer shipping times, higher per-item costs, and more complex customs procedures.

- This approach is best suited for businesses that are new to cross-border commerce, handling low-volume sales across multiple markets, or offering niche products with targeted demand.

In-House Local Warehousing:

- The seller establishes their own warehouse in the target market.

- This offers faster local delivery and better control but requires a high upfront investment.

- This approach is best suited for businesses with established, significant sales volume in a specific market, and that require tight brand control.

Third-Party Logistics (3PL) with Local Warehousing:

- Partner with a 3PL provider that has local warehouses.

- This provides access to established infrastructure, scalability, and potentially better shipping rates, reducing capital expenditure.

- This approach is best suited for businesses expanding internationally and those seeking scalability and operational expertise without requiring significant upfront investment.

5. Marketing strategy

The biggest challenge brands face when entering new markets is unfamiliarity with local consumer behaviors, cultural nuances, and effective communication channels. Without a strong local understanding, even the best products can struggle to gain traction.

To get off to a strong start, we recommend a mix of word-of-mouth, direct-to-consumer, social media ads and reels, and web ads—an ideal combination for engaging Southeast Asian consumers (Source: SEA Digital Landscape 2025 Report).

Here are some of the most effective marketing tactics we recommend:

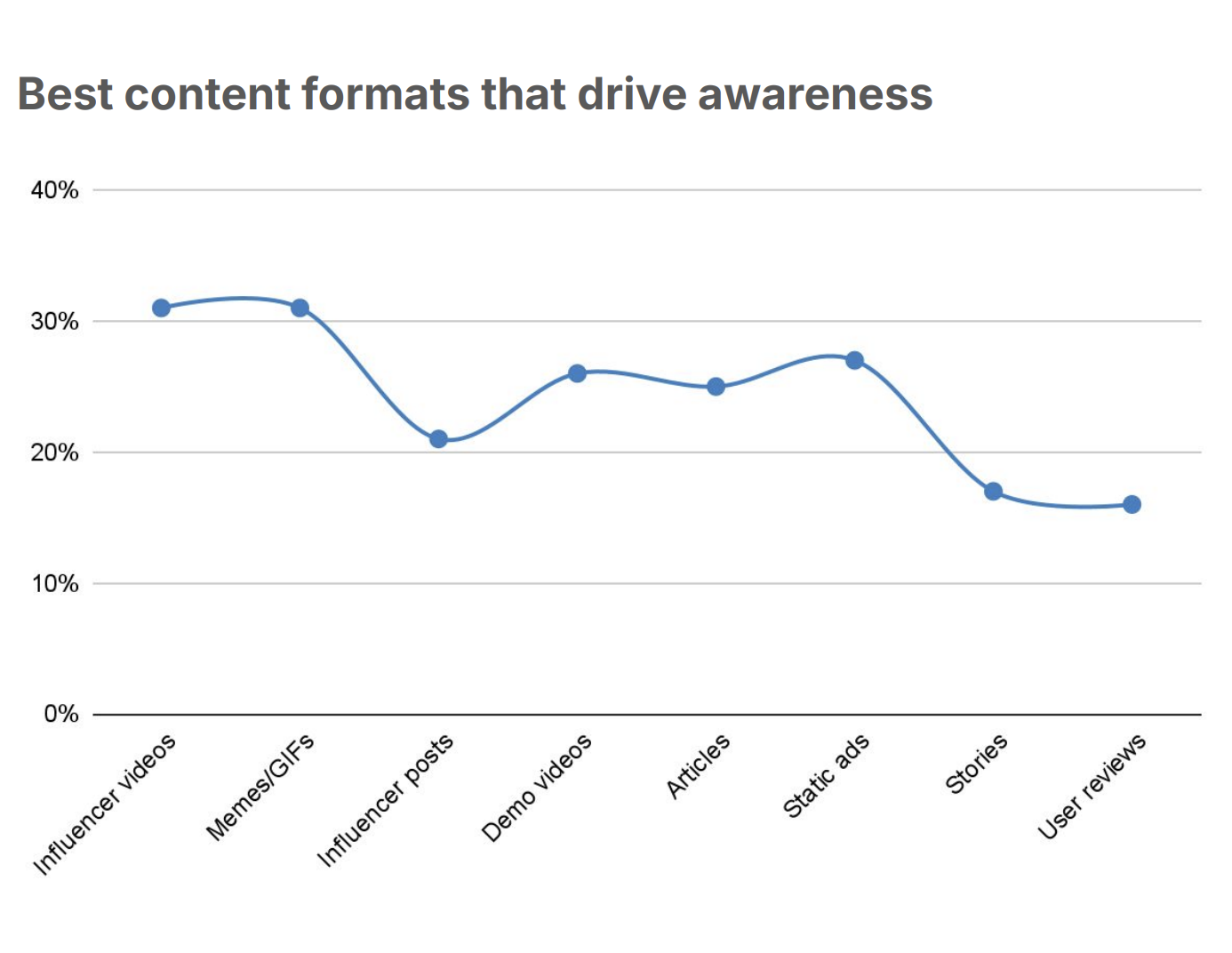

Influencer marketing is highly effective, particularly in regions like Southeast Asia, where trust in nano-influencers (1,000-10,000 followers) and micro-influencers (10,000-100,000 followers) is substantial due to their perceived authenticity and relatability. Influencers are powerful drivers of awareness, credibility, and conversions, especially in categories such as fashion, beauty, health & wellness, and travel. As shown in the chart below, influencer videos are among the most effective content formats for driving awareness in Southeast Asia.

Image 2: Best content formats that drive awareness in SEA.

(Source: SEA Digital Landscape 2025 Report)

Live commerce & social commerce are major trends, especially in various parts of Asia. Live commerce combines real-time product demonstrations, entertainment, and direct engagement with hosts to drive excitement and impulse purchases. Platforms like TikTok Shop and Shopee Live are key channels for this activity. Beyond immediate sales, live selling serves as a powerful brand-building tool and a real-time mechanism for gathering customer feedback.

Geo-targeted digital advertising utilizing platforms like Facebook Ads and Google Ads allows businesses to focus advertising budgets on specific countries, cities, or even neighborhoods, increasing ad relevance, improving campaign efficacy, and optimizing marketing spend.

7. Regulations and taxes are crucial to navigate

Each country has its own rules governing imports, exports, and consumption taxes (like VAT or GST)—many of which apply to all goods. For instance:

- Singapore’s GST is 9%

- The Philippines imposes a 12% VAT on digital services

- Thailand’s VAT is 7%

- Malaysia has a 10% Sales and Service Tax (SST) on imported low-value goods (LVG)

- Indonesia’s VAT is 11% (rising to 12% for luxury goods from January 2025)

Non-compliance can lead to costly delays, substantial fines, seizure of goods, and significant reputational damage.

AnyMind Group, here to make every business borderless

Cross-border e-commerce is full of opportunity but also complexity. At AnyMind Group, we simplify that journey by offering a BPaaS offering across marketing, e-commerce, logistics, and digital transformation.

Our unified platforms help businesses expand across Asia Pacific and the Middle East, streamlining everything from operations to fulfillment. By connecting systems and automating workflows, we enable greater scalability and efficiency, backed by local expertise and regional support.

With AnyMind, you gain the tools, tech, and teams to go borderless.

📊 Want deeper market insights? Explore our SEA Digital Landscape Report 2025.

🌍 Ready to scale globally? Get in touch or view our case studies.